Get the Best Deal on Car Insurance by Comparing Quotes

Are you looking for the best deal on car insurance? With so many companies offering different rates, it can be difficult to know where to start. But don’t worry - comparing car insurance quotes is a great way to find the best coverage at the best price. By comparing quotes from the largest auto insurance companies, you can get an accurate picture of what’s available and make sure you’re getting the best deal. Read on to find out more about why comparing car insurance quotes is the best way to get the best deal. Shopping for car insurance can be a daunting task, especially when it comes to getting the best deal. However, the process doesn't have to be so difficult. By comparing quotes from the largest auto insurance companies, you can find the best deal for your specific situation. In this blog post, we'll discuss why comparing car insurance quotes is the best way to find an affordable policy that fits your needs. We'll also provide tips on how to get the most accurate and up-to-date quotes, so you can be sure you're getting the best deal possible.

What You Need to Know Before You Start

When it comes to finding the best car insurance rates, one of the most important steps you can take is to compare quotes from different providers. However, before you start comparing quotes, it’s important to understand a few key things about car insurance so that you can make an informed decision.

First and foremost, you should be aware of the different types of car insurance coverage available. Liability coverage is required by law in most states and pays for damages that you cause to another person’s property or injuries suffered by another person in an accident. Collision coverage pays for damages to your vehicle caused by a collision with another vehicle or object. Comprehensive coverage pays for damages to your vehicle caused by non-collision events such as theft, fire, and vandalism.

It’s also important to understand the different deductible amounts available with car insurance. A deductible is the amount of money you have to pay out-of-pocket for a covered claim before the insurance company will pay for the rest. Higher deductibles generally lead to lower premiums, but if you choose a deductible amount that is too high for you to afford, you may end up having to pay for damages or repairs out-of-pocket.

Finally, it’s important to know what discounts are available from each car insurance company. Different companies offer different discounts, so be sure to ask each provider what discounts they offer before you start comparing quotes. Common discounts include those for good drivers, safe vehicles, and bundling multiple policies together.

How to Get the Best Quote

When shopping for car insurance, the most important thing to do is to compare quotes from multiple companies. Doing so will help you find the best coverage and price that meets your needs.

When it comes to getting the best quote, there are a few key steps you should take. First, you should decide what type of coverage you need, as well as how much coverage you want. This can be based on your budget, the value of your vehicle, or any other factors that are important to you.

Next, you’ll want to shop around and get quotes from different companies. Be sure to provide accurate information when getting your quotes, as incorrect information can lead to higher prices. Additionally, make sure to ask about any discounts you may qualify for, as these could save you money in the long run.

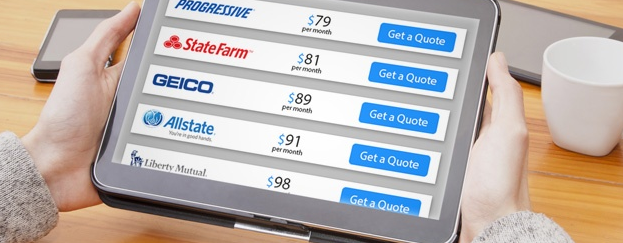

Finally, once you have collected all of your quotes, take the time to compare them side-by-side. This will allow you to compare pricing and coverage to ensure you get the best deal available. Don’t be afraid to negotiate with insurers either, as some are willing to lower rates for certain customers.

The Different Types of Quotes

When looking for car insurance, you’ll want to know the different types of quotes that are available.

First and foremost, there is the “standard policy” quote. This is the most common type of car insurance quote, as it covers you for all of the essentials such as bodily injury and property damage liability. It also typically includes coverage for medical payments, uninsured/underinsured motorist coverage, collision and comprehensive coverage, and other miscellaneous coverages.

The next type of quote is the “pay-as-you-go” or “usage-based” quote. These types of policies can be helpful for those who don’t drive very often, as they are usually tailored to your specific driving habits. With a pay-as-you-go policy, you pay a certain amount per mile or per day depending on how much you drive. This can result in significant savings since you only pay for what you actually use.

Finally, there is the “no-fault” quote. This type of coverage is available in some states and requires all drivers to carry some form of auto insurance regardless of who caused the accident. This type of policy provides you with coverage even if you are at fault for an accident.

It’s important to understand each type of quote before making a decision. Be sure to get multiple quotes from various providers to ensure that you’re getting the best coverage at the best rate. Many companies offer online tools that allow you to quickly and easily compare multiple quotes side-by-side. Keep in mind that some companies may offer discounts based on factors like having multiple vehicles insured, having a good driving record, taking defensive driving classes, or belonging to certain organizations. Additionally, it's important to read through the terms of any policy carefully before committing so that you're aware of any exclusions or limitations of the coverage being offered. If you're ever uncertain about something, be sure to contact your provider and ask questions so that you can make an informed decision.

How to Compare the Quotes

Comparing car insurance quotes is one of the best ways to save money on your policy. It's important to shop around and compare quotes from different companies so you can find the best deal. But it's also important to know how to compare the quotes accurately in order to make sure you get the best coverage for your needs.

First, consider the type of coverage you need. Different companies offer different types of coverage, so make sure you're comparing the same type of coverage with each quote. Once you have a list of quotes from different companies, compare their deductibles, limits, and other features to find out which one is the most cost-effective for you.

When comparing quotes, consider not only the price but also the quality of service. Check customer reviews and ratings for each company so you can get an idea of what kind of service you can expect. Also look at the company's financial stability and ratings from independent rating agencies.

Finally, make sure to read the fine print. Each policy will have specific terms and conditions that may affect your coverage. Read through the fine print carefully and make sure you understand what you're signing up for before committing to any policy.

Comparing car insurance quotes is a great way to save money on your policy. By taking the time to compare the different options and understand the coverage you need, you can make sure you get the best deal possible.

What to Do if You Have a Claim

If you find yourself in the unfortunate situation of needing to file an auto insurance claim, it’s important to know what steps to take. The first step is to contact your insurance company as soon as possible. Provide them with all the details of the accident or incident that caused the damage. Make sure to document any damages, take pictures if possible, and provide a police report if applicable.

Your insurer may require additional information from you. This could include medical records and other proof of losses related to the claim. Having a copy of your policy handy can help speed up the process and make sure that you are getting the coverage that you need.

The next step is to work with the claims adjuster assigned to your case. They will investigate the circumstances of the incident and determine how much the claim is worth. Once they have evaluated all the evidence, they will be able to come to a conclusion about the amount of coverage you will receive for your claim.

Keep in mind that even if your insurer determines that you were at fault for an accident, you still may be eligible for compensation. If you feel like you are not being adequately compensated for your loss, speak with a legal professional who can help you negotiate a better settlement.

No one likes to think about filing an insurance claim, but knowing what steps to take can help make the process smoother and ensure that you get the compensation you deserve. When choosing an auto insurance provider, make sure to do your research. Read reviews online and ask family and friends for recommendations. It’s also wise to compare quotes from multiple companies before making a decision. Finally, be sure to ask questions about their claims process so that you understand exactly what steps you need to take if the need arises.

Post a Comment for " Get the Best Deal on Car Insurance by Comparing Quotes"